Table Of Content

- That annual fee

- How does this offer compare to past Business Platinum offers?

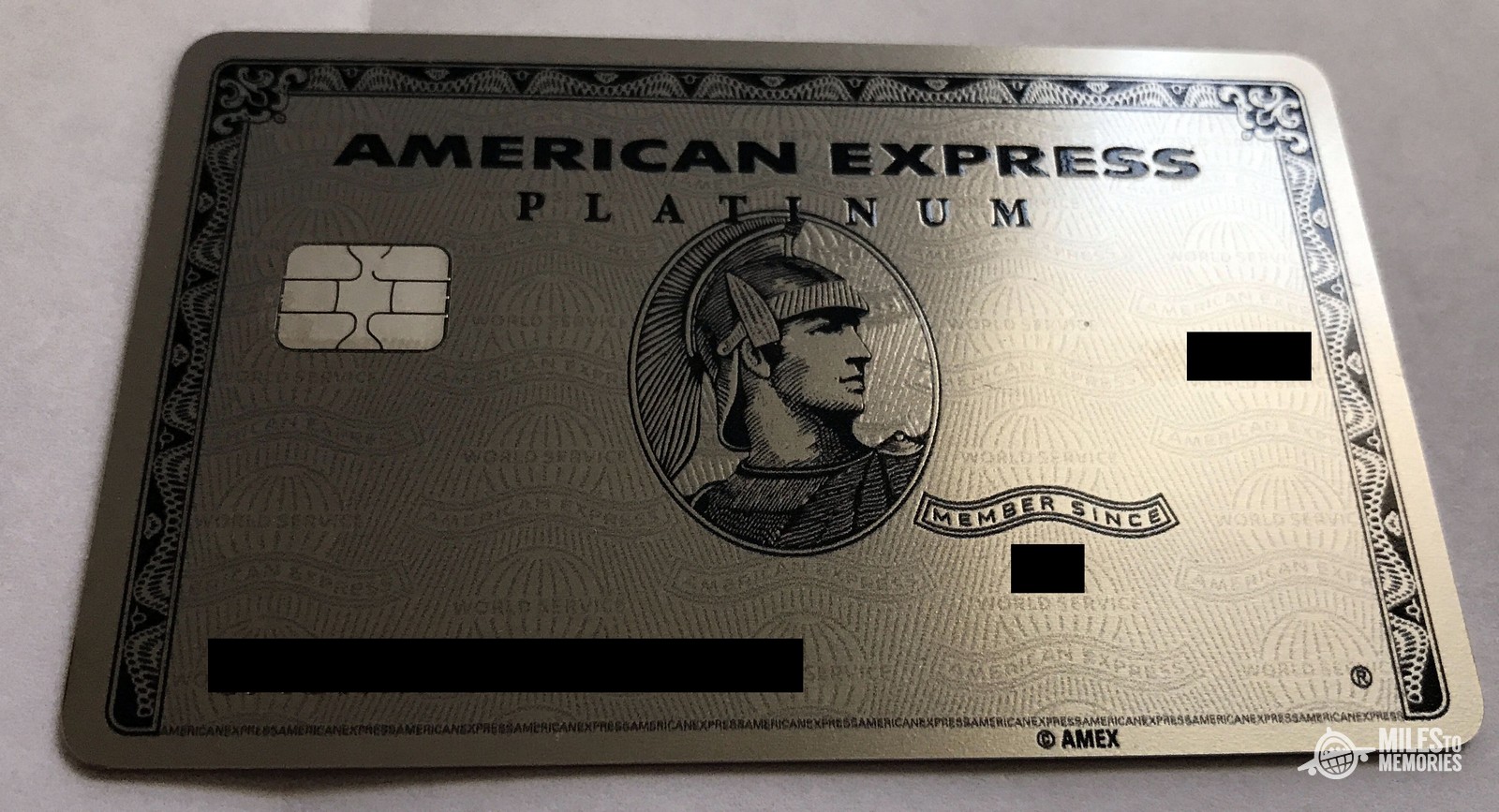

- Art x Platinum Designs Transform The Platinum Card® Into a Work of Art

- Digital entertainment credit

- Up to $240 Digital Entertainment Credit

- The American Express Business Platinum Card has a new 150,000-point offer. Here’s who should consider it

Cardholders can receive up to $300 annually in credits toward Equinox gym memberships or digital subscriptions to on-demand fitness classes through the Equinox+ app. If you stay at hotels even a few nights a year, these benefits can be extremely valuable — Hilton offers Gold elites free breakfast for two each morning (currently awarded as a food and beverage credit in the US). Successful application for the Amex Platinum card likely requires excellent credit and decent income figures, meaning it’s a relatively difficult card to obtain. Carefully consider whether the card will yield enough value for you before applying. Although there’s no official checklist required to qualify for the Platinum American Express card, in general, your odds of approval are better with an excellent credit score and solid financial standing. When reviewing your application for a card, in addition to your credit score, issuers will consider your income, how long you’ve had credit and what other credit lines are already extended to you.

That annual fee

The Guide to Adding an Authorized AmEx Platinum User - NerdWallet

The Guide to Adding an Authorized AmEx Platinum User.

Posted: Fri, 19 Apr 2024 07:00:00 GMT [source]

If you want to cancel, be sure you have another Membership Rewards points-earning card open so you don’t lose access to your points. When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card® from American Express. In addition to Walmart+, Amex has added an up-to-$300 statement credit when purchasing one SoulCycle at-home bike. The Global Dining Access program by Resy gives Platinum cardholders exclusive reservations at some of the world's top restaurants, along with access to premium events. However, it's clear from the specific nature of several of these credits that many cardholders will not be able to fully utilize all of these perks.

How does this offer compare to past Business Platinum offers?

Annual credits are Clear, prepaid hotel, SoulCycle and airline; monthly are Equinox, digital entertainment, Walmart+ and Uber Cash; biannual is Saks Fifth Avenue; and the Global Entry/TSA PreCheck enrollment fee credit is every 4.5 years. However, several of these perks are relatively niche and wouldn't be useful for all cardholders. In addition, there comes an opportunity cost in terms of tracking all of these benefits. For example, there are now 10 credits on the Amex Platinum — four are yearly, four are monthly, one is biannual and one is every 4.5 years. Earlier this summer, the Amex Platinum's annual fee went from an already high $550 (see rates and fees) to an even more expensive $695 (see rates and fees).

Art x Platinum Designs Transform The Platinum Card® Into a Work of Art

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on the Card in your first 6 months of Card Membership. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Inc. (Member SIPC), and its affiliates offer investment services and products. Its banking subsidiary, Charles Schwab Bank, SSB (member FDIC and an Equal Housing Lender), provides deposit and lending services and products. If you have multiple eligible Schwab accounts, each time you make a redemption you will be asked to select the account in which you would like the deposits by Schwab to be made.

If you fit the profile that can take full advantage of the perks offered with the American Express Platinum Card, or if you value widespread airport lounge access at any price, this card fits the bill. But for most consumers, you’re unlikely to use most of the perks offered on this card. If you can use enough of the card’s shopping and travel credits, you could wipe out the card’s $695 annual fee completely and all of the other benefits will be gravy on top. The most prominent competitor of The Platinum Card® from American Express among premium travel cards is the Chase Sapphire Reserve®.

Up to $240 Digital Entertainment Credit

While the Amex Platinum card no longer includes complimentary guest access to Centurion Lounges (unless you spend $75,000 on the card annually), you can still bring in up to 2 guests into Escape Lounges. What I realized is that sometimes the value you can get from a credit card doesn’t just come down to dollars and cents. Sometimes, the value you get is higher than the dollar amount saved by holding that card. I value lounge access quite a bit when I am traveling because a quiet area with free food and drinks can turn a stressful travel day into an enjoyable journey. If you decide the Amex Platinum card isn’t worth it for you, consider downgrading to another card instead of canceling.

The American Express Business Platinum Card has a new 150,000-point offer. Here’s who should consider it

For example, your authorized users can help you hit a minimum spending requirement to earn a welcome offer, or you might want to build your child's credit history early on. Additionally, cardholders who make 30 or more purchases with their card in a billing period earn 50% more points, making the Everyday Preferred a potentially lucrative card for daily expenses. It achieves the important feat of balancing out the Amex Platinum Card’s benefits with a much lower annual fee while offering access to the same exceptional rewards program. The American Express Gold Card is renowned for its generous rewards structure, particularly its high earning potential in categories like restaurants (worldwide) and U.S. supermarkets.

Julie Mehretu, a renowned abstract artist, reimagines the Platinum Card as contemporary art. If your business regularly spends in these categories, your ongoing return potential may be higher with the Business Gold than the Business Platinum. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Best American Express credit cards in April 2024 - CNN Underscored

Best American Express credit cards in April 2024.

Posted: Tue, 23 Apr 2024 14:21:00 GMT [source]

Uber Cash

The Amex Platinum has undergone significant changes in recent years and carries a steep $695 annual fee (see rates and fees) — one of the highest on the market. That's why people often ask whether the Amex Platinum is still worth the annual fee, even with the new perks. Signing up for this offer could make even more sense if you travel frequently, as you can get exceptional value by paying with points for all or part of an eligible flight booked through American Express Travel. Bankrate.com is an independent, advertising-supported publisher and comparison service.

No other travel rewards card offers access to so many different lounge networks. If you don't have a small business or aren't a big spender, the Amex Platinum Card is probably the better option, since the minimum spending requirement to earn the welcome bonus on the Amex Business Platinum Card is quite high. Read our comparison of the Amex Platinum and the Amex Business Platinum for more details. The Amex Platinum Card earns Membership Rewards points, the currency of Amex's loyalty program. And while the full list of annual statement credits are, combined, worth more than the annual fee, you actually need to use them to get any benefit.

With that said, let’s take a look at The Platinum Card® from American Express, which has card perks valued at $1,400! Unfortunately, this means that there will be a high annual fee (the annual fee is $695–See Rates & Fees). However, the numerous perks that come with this travel card, including airline credits, access to airport lounges, and upgraded status (enrollment may be required), help offset the fee.

No comments:

Post a Comment