Table Of Content

You can also use your Membership Rewards points to book travel directly through American Express Travel. But if the personal Amex Platinum is the only Amex card in your inventory, using points for airfare and hotel redemptions this way won't get you amazing value. Let's dig into the details and benefits to see whether having the Amex Platinum in your wallet makes sense for you. Other than booking airfare – which gets you 5x points for every dollar you spend directly with the airline or through Amex Travel – there are simply much better options for your everyday spending.

Digital entertainment credit: $240, in $20 monthly increments

Sometimes it’s worth a large investment to reap the benefits of a great credit card. In exchange for the annual fee, you’ll unlock access to the Amex Membership Rewards program that let you access airline and hotel transfer partners, along with new lifestyle and travel credits. This card is also incredibly rewarding for travel purchases, helping you rack up a ton of Membership Rewards points for your next award trip. Make no mistake — the Amex Platinum card is a premium card with a premium price tag.

Marriott and Hilton elite status

It’s a premium card with a long list of benefits, but unfortunately, it also has a premium annual fee. I’ve had an Amex Platinum card on and off for the better part of a decade. It’s a no-brainer when you can get a big welcome bonus offer or a retention offer, but its high annual fee makes it one that won’t be right for everyone long-term.

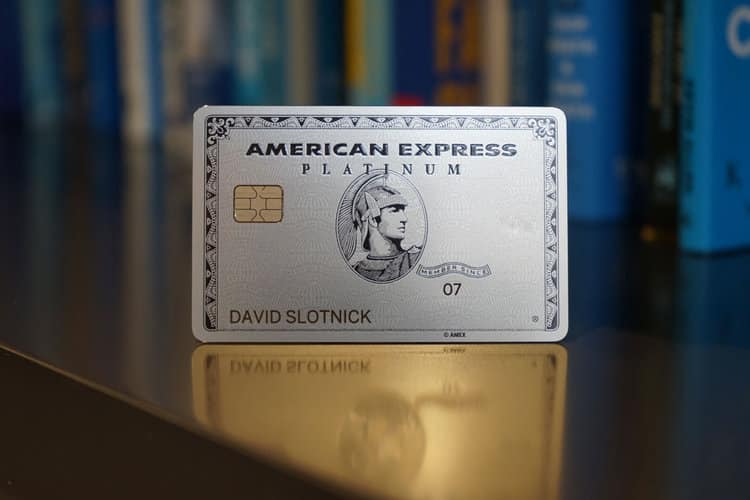

Review of The Platinum Card from American Express

The American Express Platinum and the Chase Sapphire Reserve are both premium travel cards that offer a variety of rewards and benefits. The Amex Platinum offers a higher welcome offer, more airline transfer partners and access to luxury airport lounges. The $550-annual-fee Chase Sapphire Reserve offers better rewards for dining and travel purchases, a larger selection of redemption options and primary rental car insurance. You can also redeem your rewards at a 50% increase when booking travel through the Chase Travel℠ portal.

Ariana Arghandewal is a travel hacker and travel rewards expert who leverages credit cards to earn over a million miles every year. She is the founder of Pointchaser, an award-winning blog where she covered rewards travel and credit cards since 2012. Nowadays, it seems every bank, airline and hotel offers a premium travel rewards card.

Best Credit Cards Of May 2024 – Forbes Advisor - Forbes

Best Credit Cards Of May 2024 – Forbes Advisor.

Posted: Fri, 26 Apr 2024 16:05:00 GMT [source]

Plan It® lets you set up a payment plan for eligible purchases, during which you pay a monthly fee instead of interest charges. "Pay Over Time" lets you finance eligible purchases over a term with interest. There is a limit to the amount you can finance with a Pay Over Time plan. Purchases that aren't covered by Plan It® or Pay Over Time must be paid in full.

Please view our advertising policy and product review methodology for more information. But some cards also offer authorized users many of the same benefits as the primary cardholder — one of the most popular being The Platinum Card® from American Express. However, there have been a number of changes in 2023 that have made this a more complicated decision. Most notably, it'll now cost you $195 per additional Platinum cardholder each year (see rates and fees). There are many reasons why you'd want to add authorized users to your travel credit cards.

Fee credit for Global Entry or TSA PreCheck

Finally, Platinum cardholders now get up to 40% off the private jet program with Wheels Up. For instance, the initiation fee for the Wheels Up Core Membership for Platinum cardholders is $10,500, which is 40% off the standard initiation fee of $17,500. Step into a world of privilege and prestige with American Express.

Best Premium Credit Cards of May 2024 - NerdWallet

Best Premium Credit Cards of May 2024.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

Those who travel frequently and can take advantage of the card’s benefits should get the Amex Platinum Card. The card offers a great rewards program with points for flights, hotels, and more. It also has no foreign transaction fees, making it ideal for frequent travelers.

If you are looking for more generous rewards for flights and prepaid hotels as well as additional perks such as lounge access and hotel status benefits, then the American Express Platinum card is a better fit. However, if you are looking for a lower annual fee along with primary rental car insurance coverage, then the Chase Sapphire Reserve may be better suited to your needs. If you want your authorized users to receive select card benefits, including airport lounge access, a TSA PreCheck or Global Entry credit, and hotel/rental car elite status, you can add Platinum authorized users at a cost of $195 each. Keep in mind that the spending rewards provide only a portion of this card's overall value. To get the most value for your hefty annual fee, you'll want to make use of the card's extensive list of perks.

The Amex Platinum has new card designs from artists, and cardmembers can request their cards as of today (January 20, 2022). This is available to both new and existing cardmembers of the personal card in the United States. The designs are cute, though obviously this is style over substance. Existing Card Members can request to change their current card design by logging into their American Express account or calling the number on the back of the Card.

Meanwhile, the American Express Platinum Card offers lucrative rewards for travel-related expenses such as eligible flights and hotels. Both cards earn valuable Membership Rewards points, which are arguably some of the most flexible and valuable points you can earn. When combining the Amex Platinum and Amex Gold cards, cardholders can earn points at an accelerated rate across a wide range of spending categories, catering to both everyday needs and travel. Additionally, unlock over $1,000 in annual statement credits on the curation of business purchases, including select purchases made with Dell Technologies, Indeed, Adobe, and U.S. wireless service providers.

Late checkout, free in-room internet, and a 5th night free when you redeem rewards points for the first four nights. If you want to learn about Marriott’s credit cards, check out our guide to the best Marriott credit cards. Hilton Gold status allows you to get a free breakfast, a 25% point bonus, and a free 5th night on a multi-night stay.

The annual fee is high, but the card’s potential value can make up for it. The Platinum Card comes with a $695 annual fee (see rates and fees) and has so many benefits that it's often referred to as a "membership card" — a card that you keep for its benefits rather than its earning potential. If you spend a lot on dining, whether by eating out or ordering in, and at U.S. supermarkets, the American Express® Gold Card is worth considering. It earns 4x points at restaurants and 4x points at U.S. supermarkets (on up to $25,000 per calendar year, then 1x), and it offers up to $10 in monthly statement credits at select restaurants. It has a lower annual fee of $250, but it doesn't offer the various luxury travel benefits of the Amex Platinum Card. If you're on the fence, read our Amex Gold Card review for more info.

These benefits include a room upgrade upon arrival (when available), daily breakfast for two, guaranteed 4 p.m. Late checkout, noon check-in (when available), complimentary Wi-Fi and an experience credit valued at $100 or more. The information for the Hilton Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer. Still, having an authorized-user Platinum Card covers both programs and thus may be easier than maintaining multiple other cards.

No comments:

Post a Comment